As we look forward to the new year and its opportunities, Tecum Capital reflects on our accomplishments in 2024. We are thankful for our trusted supporters, their strong relationships, and our team efforts that contributed to our success and growth this past year. We are eager to build new relationships and continue strengthening our current alliances. We anticipate an outstanding 2025!

Tecum Capital Investments

Tecum Capital Add-ons

Tecum Capital Exits

Tecum Equity Investment

Tecum Equity Exit

Enjoy our 2024 video recap!

About Tecum Capital

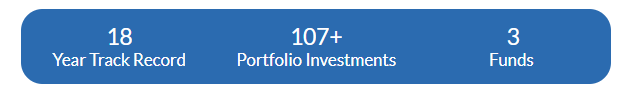

Tecum Capital Management, Inc. (“Tecum”) is a Pittsburgh, Pennsylvania-based private investment firm deploying capital in lower middle market companies. Tecum provides mezzanine debt and equity investments in growth-oriented middle-market companies across many industries, including manufacturing, value-added distribution, and business services. Our team partners with independent sponsors, family offices, committed funds, business owners seeking succession plans, and management teams to create shared success. Tecum focuses on businesses with EBITDA greater than $3 million and will invest $5 million to $20 million in potential portfolio companies. Tecum manages two Small Business Investment Company (“SBIC”) licensed funds and is currently investing out of Tecum Capital Partners III, L.P, a $300 million fund launched in September 2021. Tecum also manages a separate micro-cap equity control strategy via a multi-family office strategy with investment criteria encompassing EBITDA of $2 million to $6 million called Tecum Equity Alpha Management (“TEAM”). Since 2006, the team has collectively invested more than $1.0 billion in over 100 platform and add-on acquisitions. For more information, please visit www.tecum.com.